The Best Credit Repair Companies of 2022

The top credit repair companies are no big secret. Check out CreditRepairPartner.com’s list of credit repair companies that can help you tackle your financial challenges.

- Credit Saint: Best Overall

- Lexington Law: Best for Legal Expertise

- CreditRepair.com: Best Track Record

- The Credit Pros: Best Well-Rounded Service

- The Credit People: Best Bonus Features

- Sky Blue Credit Repair: Best for Budget

- Ovation Credit Services: Best Customer Service

Credit Saint – Best Credit Repair Company Overall

- Consistently ranked as the top service on finance sites

- Offers unlimited challenges per dispute cycle

- Free non-obligatory credit repair consultation

- Tailors services and disputes to each situation

- One-to-one inquiry assist process

- BBB Accredited

- 90-day refund policy means a worry-free service

- Offers education on other ways to optimize scores

- Intuitive dashboard for tracking challenges

- Responds to complaints with care and attention

- Well-rounded basic package for $79.99

- Setup fees are above industry rates

- Only available in 39 states

Credit Saint offers a three-month guaranteed full return of your purchase if their credit repair process has not resulted in any removals within 90 days. This debt repair company has “top-rated services” for clients, like 24/7 access to repair specialists. Clients are paired with a dashboard with an analysis score that reflects how the disputes are working.

Just like Lexington Law, Credit Saint has three options for you to select depending on your financial position and the services you require.

- Credit Polish — $79.99 a month: this is the basic plan that includes challenges to the three top bureaus, score analysis, creditor interventions, and the score tracker.

- Credit Remodel — $99.99 a month: this is the middle package containing everything from Credit Polish in addition to inquiry targeting and Experian monitoring. With the Credit Polish plan, you may only choose up to 10 incorrect items from every dispute cycle you try to remove.

- Clean Slate — $119.99 a month: this is Credit Saint’s priciest but most popular plan. It includes everything from the first two packages, but the main difference is that you get to challenge an unlimited number of inaccurate items.

If you want to see the progress made on your score through this company, you can check the updates in the personal dashboard Credit Saint assigns each of its clients. Credit Saint is accredited by the BBB with an A rating. As for the customers, they gave it a 3.28 out of 5.

On their Google Reviews page, most of the feedback is overwhelmingly positive. They currently maintain a 4.5 rating from about 1,300 reviews. Many customers laud the service representatives for their personal credit counseling.

Lexington Law – Best for Legal Expertise

- Utilizes digital partnerships for faster outcomes

- The most popular credit repair app on Android and iOS

- Founded and operated by attorneys

- A Progrexion Holding Inc Consumer Brand

- Highly experienced with 221M+ challenges since 2004

- Offers coaching to encourage good credit behaviors

- Leverages each angle of the law for better success

- Known for fast and effective disputes

- Monitors each aspect of the service through the app

- Offers dedicated focus tracks to deal with life events such as divorce

- Packages have become expensive

- No service guarantee or refund policy

- Not BBB Accredited

This repair law firm offers three plans that vary based on price and different repair needs. The three packages (Concord Standard, Concord Premier, and Premier Plus) cost between $89.85 and $129.95 a month.

Package breakdown:

- Concord Standard — $89.95 a month: the basic package includes bureau challenges and lender disputes.

- Concord Premier — $109.95 a month: the next option offers slightly more. It consists of everything in the Concord Standard plan plus a score analysis, TransUnion messages, and extra benefits that help you stay vigilant with your repair growth.

- Premier Plus — $129.95 a month: the most detailed package comprises everything in the Concord Standard and Premier packages, along with dispute letters, Fair Isaac Corporation (FICO) score analysis, identity protection, and more.

One of this company’s beneficial attributes is its free app for its customers to use! The app helps clients monitor their debt repair growth as aid from the selected package begins to work. The company built the app to create a more user-friendly client experience than the Lexington Law desktop page.

Lexington Law has several positive attributes, and the law firm has a lot of ratings through the BBB (Better Business Bureau), but you should note that they are not accredited. The company’s BBB rating is a C, and its repair customers’ ratings average 2.01 out of 5.

We like that they offer dedicated focus tracks to help customers resolve unfair negative entries that may have resulted from divorce, national disasters, student loans, etc. For instance, their divorce focus track includes tailored interventions focusing on lenders and the major credit bureaus for jointly shared accounts.

The firm is currently offering a COVID-19 national relief focus track, where they go after negative entries that may have resulted from the devastating impact of the pandemic for a chance to revamp credit scores.

CreditRepair.com – Best Track Record

- Offers a credit improvement plan during the free evaluation

- No long-term contracts - cancel any time

- Provides mobile apps for case tracking and report updates

- Reviews reports and items before recommending a package

- 1 Million+ interventions since 2019

- Saving money on the Direct plan at only $69.95

- Lots of freebies during the free consultation

- Utilizes the same technologies as Lexington Law

- Sends updates thru text, apps, and email

- Not highly reviewed by users

- Lacks a money-back promise

- Not BBB Accredited

CreditRepair.com is a service with lots of experience to back it up. It also offers commitment-free services like consultations and an improvement plan, so you can visualize what needs to be disputed before you even make the decision to retain Credit Repair’s services. The company also will show you in your free consultation what items you can dispute for free.

CreditRepair.com has three packages to choose from with varying prices.

- Direct Package — $69.95 a month: this basic package includes “bureau challenges, inquiry assists, goodwill intervention, and quarterly credit score updates.”

- Standard Package — $99.95 a month: this package includes everything from the first package with the addition of “monthly score updates, more bureau challenges, more creditor interventions, and cease interventions.”

- Advanced Package — $119.95 a month: this higher-cost package consists of everything from the first two packages plus “monthly score updates, more bureau challenges, more creditor interventions, and cease and desist interventions.”

Services from this business typically take about three months before the progress is reflected in your score, which you can track through your own portal that your repair specialist sets up for you.

Creditrepair.com has a low BBB rating of a D and is not BBB accredited. However, it has great customer reviews. They have been in business for 9 years and have removed over 1.8 million items from customers’ reports. If you want to know more about its services, you can call one of its numbers for a free 10-minute analysis.

The credit repair service even offers iOS and Android apps to simplify case tracking and receiving score updates. Despite all these overwhelmingly positive traits, the key drawback of the service has been the lack of a money-back assurance. They may fail to issue refunds if their credit repair process doesn’t produce any results.

The Credit Pros – Best Well-Rounded Service

- Provides an AI-Driven credit management system

- Staffed by FICO® certified experts

- Unlimited disputes on all credit repair packages

- BBB Accredited Business

- Plenty of extra features with each package

- 90-day assurance

- Launches more disputes during each billing cycle

- All plans include access to their legal network

- Facilitates credit building thru National Direct

- Personalized help at all stages

- Book a convenient time to receive the free call

- Provides mobile apps and personal finance tools

- Charges a setup fee of $119 for their $69 plan

- Few credit education resources

- Lacks a clear website and performance stats

The Credit Pros has the benefit of being a data-driven company that strives to create the best outcome based on your position. While you work with them, they offer score monitoring so you can keep up with your repair growth.

This company features unlimited dispute letters, and unlike the rest, it has four packages to choose from:

- CreditSentry Monitoring — $19 a month: this plan covers many services, including several aspects of ID monitoring (dark web protection), TransUnion score monitoring, and more financial information. It’s a basic plan with not a lot of services.

- Money Management — $119 a month: this next package features a lot more than the first, such as bill reminder systems and a debt monitoring system.

- Prosperity Package — $119 a month: covers everything from the CreditSentry and Money Management plans, but not National Credit Direct.

- Success Package — $149 a month: the highest-cost plan covers everything from the previous packages along with National Credit Direct and a feature where you can save up to 80% on medication.

The Credit Pros is a company that has been around for 12 years. It has a BBB rating of B+ and a customer review rating of 2.58 out of 5. There are several options you can choose from based on your budget limits and what features you would benefit from using. Inc. Magazine ranked it as one of America’s fastest-growing companies.

It’s also one of the best and fastest credit repair companies that backs its services with a 90-day assurance. It entitles customers to a full refund if there have been no deletions of negative items within 90 days.

The Credit People – Best Bonus Features

- Refunds the last month’s payment to unsatisfied customers

- Score tracking on TransUnion, Experian, and Equifax

- Good track record of more than 15 years

- Unlimited custom challenges

- Offers a flat-rate six-month subscription at $74 less

- The lowest setup fee in the industry

- Provides help beyond credit repair

- No complex pricing options making it easy to start

- Toll-free customer service lines

- Mid-term cancellation without any charges

- Free consultation doesn’t include a lot of value

- No profiles or credentials of its experts

The Credit People has a lot of success to prove that it is a good repair company. The company’s website promotes its “unbeatable satisfaction guarantee” for better reports and higher scores. This company has two packages for you to choose from instead of three or four, like most companies on this list. Each package includes the same features but with different pricing models.

They feature a monthly and a flat-rate membership.

Monthly — $19.

Flat-rate —$419 for six months of service.

Both packages include the following:

- 24/7 account access to track your progress

- Free report and scores

- Score-driven results from data

- Unlimited disputes

- Creditor communication

- Certified FCRA

- Debt validation, and more

What makes this credit repair company different from the rest of the best repair companies of 2022 is that this firm offers one of the lowest rates. You can start with them for just $19 a month if you choose the monthly package, which comes with everything you need to help rebuild your score.

The Credit People have a BBB rating of C+ and an average rating of 1 out of 5, but this may be inaccurate since only four people have reviewed the service on BBB.

If you think this might be your best fit, give them a call.

Sky Blue Credit – Best for Budget

- Offers one credit repair package at $79

- Provides a 90-day money-back guarantee

- Its 35-day dispute cycle includes 15 disputes

- Helps customers research on Statute of Limitation Laws

- Fully-featured packages with creditor inventions

- Flexible billing management with pause & resume

- Reputed for being honest and helpful

- Plenty of tutorials, tips, and How-to guides

- Simple and clear 90-day satisfaction guarantee

- Fees for the top plan are lower on average

- No finance tools or ID protection

- The website lacks team profiles

Sky Blue Credit promotes four steps on its website: registration, signing up, challenging items, and raising your score.

Sky Blue has only one plan for clients to select, unlike the previous companies on the list. It gives clients three months to ask for their money back if they are not satisfied with the results. This company charges a fee of $79 a month for its services instead of offering various plans.

Sky Blue offers the following:

- A specialist working over your disputes

- Five disputes per bureau in 35 days

- Disputes tailored to your information

- Score assistance

- SOL research

- Score rebuilding

- Debt validation

- Goodwill letters

- Cease and desist

Another plus of this company is that you have the flexibility to pause, resume, and select your billing date whenever you need it. This can help you manage your budget, which is exactly what you need while trying to improve your score.

If you are unsure if this company is the one you should work with, know that they do not help people who are legitimately in debt or who have filed for bankruptcy. However, if you just need to improve your score and have someone look through your reports for inaccurate data, then this trusted repair company might be best for you.

Sky Blue Credit Repair is not a BBB accredited company, and it has an A+ rating on BBB. Among customers, it has a high rating of 3.95 out of 5! Sky Blue should be considered due to its customer ratings and low cost.

Ovation Credit Services – Best Customer Service

- Utilizes a proprietary electronic disputing system

- Became a Lending Tree subsidiary in June 2018

- The month-to-month contract allows users to cancel anytime

- Sends recommendation letters to potential lenders

- Offers unlimited dispute letters per billing cycle

- More disputes per cycle with no limits

- Updates from a personal case manager

- Launching disputes by ordering fast-track

- Qualify for a wide range of discounts

- Unfiltered reviews directly from their website

- Stopped updating their education center

- No money-back guarantee

- No mobile apps

This company’s services promote “comprehensive and personalized repair services” on its website, which means it tailors how it operates to meet your needs. Ovation offers a free consultation and a report summary to help you make your decision.

They remove a multitude of significant hits that will have a considerable impact on your score, such as:

- Late payments

- Collections

- Foreclosures

- Inquiries

- Charge-offs

- Judgments

To start, a credit repair specialist will speak with you and collect your information to see what needs to be disputed. Then you will work with a personal case advisor one-on-one. They have a portal called “Case Management Website” that is open 24/7 so you can communicate with your advisor and track your progress.

This company offers two service plans to its clients: The Essentials Plan and the Essentials Plus Plan.

- Essentials — $79 a month: offers personalized dispute options, a personal case advisor, and financial management tools.

- Essentials Plus — $109 a month: offers everything from the Essentials Plan in addition to unlimited challenge letters, unlimited goodwill letters, official Ovation recommendation letters, and TransUnion credit monitoring.

If there are several significant items to dispute on your score, then the Essentials Plus package is the right one for you.

The great thing about this debt repair company is that it has high BBB and customer ratings. Ovation Credit Services has a BBB rating of A+ and a customer review rating of 3.71 out of 5.

Ovation Credit is actually among the few BBB accredited credit repair companies. It’s affiliated with LendingTree, the largest online loans marketplace. While the repair service cannot issue loans directly, they support customers by preparing custom recommendation letters.

Other Credit Repair Companies Available in the Market

Did none of the above professional services catch your attention? No worries! Check our top alternatives to the best credit repair companies in 2022. Learn all about their unique features, along with why people love them.

CreditFirm.net

- BBB Rating: C+

- Setup fee: $49.00

- Monthly fee: $49.00

- Website: www.creditfirm.net

Jumpstart your account mending with an individual plan for this entity’s lowest price. Or, receive a $10 discount for partnership plans. While this business is not currently BBB accredited, it has been around for 15+ years now. The benefits of cheap credit repair companies like this one are that you can stop using them at any time, and they can help a large array of services.

- 5+ different up to date security certifications

- Your documents will be audited by a real attorney

- Transparent about its results

- Mixed feedback from customers

- Its website is difficult to navigate

Credit Assistance Network

- BBB Rating: A+

- Setup fee: $180

- Monthly fee: $50

- Website: www.creditagenda.com

This credit restoration institution begins its cost structuring low, but depending on what you need, you can expect to pay up to $140 per month. Due to its high setup costs, you should not use this service unless you are certain you need it. The organization has been in business since 2004, and has had many happy customers over the years!

- Offers one on one consulting

- Pay as you go

- Toll-less telephone support

- Broken links on its website

- Outdated platform

Credit Glory

- BBB Rating: B+

- Setup fee: $199

- Monthly fee: $99

- Website: www.creditglory.com

Credit Glory’s phenomenal reviews and rankings make it one of the better choices. It has only been in business for about four years, which might lead some to think it’s unreliable. However, its new industry presence has actually given it an edge when it comes to utilizing recent technology. No wonder it has nearly five stars on every major review website. Plus, it has removed over 30,000 negative items from people’s credit history in only the past month. The proof is in the pudding.

- The setup fee only gets taken out of your account once your letters are sent

- 3-month money-back guarantee

- Certified by FICO itself

- 1,200+ reviews

- Accessible online, but only has twelve different physical locations

- Only works with seven types of challenges

Pinnacle Credit Repair

- BBB Rating: C+

- Setup fee: –

- Monthly fee: $500

- Website: pinnaclecreditrepair.com

Pinnacle is a top alternative to the best credit repair companies of 2022. Not only is its website super easy to navigate, but it has 4.7/5 star ratings. It got so far in the game by utilizing some of the best credit repair software available to facilitate challenges with the credit bureaus. This excellence does come with a hefty price tag though. If you need speed, then you could pay up to $2,500 for fast-tracking. The latter option, fortunately, comes with a money-back guarantee.

- Combines artificial intelligence and a human touch

- Fast tracking makes it faster than alternatives on the market

- Enables you to post multiple challenges at the same time

- Simple, modern digital presence

- Poor rating, which does not seem to comport with its great reviews

- The no-satisfaction refund only applies to its fast-tracked services

AMB Credit Consultants

- BBB Rating: C

- Setup fee: $149

- Monthly fee: $99

- Website: ambcreditconsultants.com

Enrolling comes with all of the basic online credit repair perks. To enroll, all you need to do is choose your preferred service, sign up with a site to monitor your score, and fill out the company’s form. In as little as half an hour, you’ll be on your way to financial freedom.

- Available for the average cost of credit repair services

- Join in only three steps

- 11+ years of business

- Consultation only lasts fifteen minutes

- Outdated website

Pyramid Credit Repair

- BBB Rating: None

- Setup fee: None!

- Monthly fee: $99

- Website: pyramidcreditrepair.com

Get a free consultation on credit repair help with Pyramid. The company has 2,400+ real 5-star reviews on Google. Plus, it’s pretty cheap, even if you want a couples plan, for which you’ll only have to pay $198/month. Lucky for you, plans come with free extra services and a money-back guarantee. Even without accreditation, it’s one of the best options on this list. You have nothing to lose by trying it out.

- A simple, modern website that’s easy to use

- Team of 200+ employees

- Logs 8,000+ yearly hours of customer support

- Can put your account on hold

- Need a joint financial account for the couples discount

- Takes on average 45 days to see results, which is longer than some alternatives

Credit Fix Guy

- BBB Rating: A

- Setup fee: $50

- Monthly fee: $20+

- Website: creditfixguy.com

Fix Guy is well-known in the credit repair industry. It does not require any hidden extra fees, and you do not even have to provide the organization with your social security number! Your letters of dispute can be prepared and sent to credit bureaus in as little as 3 days. Imagine having your life changed in 72 hours! So if you need instant credit repair services, this is probably going to be your best option. It’s inexpensive, ultra-convenient, and can give you a 100+ point boost in only two months.

Most credit repair companies cannot boast about so many pros at such a low price. Whether you are having issues paying off your card or cards, the Fix Guy can help you out.

- New website

- Month to month billing with no long term contracts

- Complies with the Fair Credit Reporting Act

- Super affordable

- You have to mail your own letters

- Better for short-term clientele

Credit Monkey

- BBB Rating: B

- Setup fee: None

- Monthly fee: $99+

- Website: creditmonkey.com

If you’re looking for good credit repair companies for problems that require complex fixes, this is a strategic choice for you. They provide assistance with eight different major areas of credit problems and will provide you with a free credit consultation to figure out if they will be able to help you. Plus, they have six different flexible plans, ranging from Plan A, its cheapest option, to Plan F, at $499/month. Depending on how severe your problem is, you will only have to pay for what you actually need.

Plus, check out the companies real reviews on Yelp, Facebook, and Google. Their packages are tailored to provide aggressive credit repair.

- A clean website that won’t confuse you

- Plenty of plans to choose from

- Will refund you after three months if you aren’t pleased

- 24/7 portal access

- Has only been around since 2019

- Limited to the fifty states

Credit Versio

- BBB Rating: None

- Setup fee: $99–195

- Monthly fee: $20+

- Website: www.creditversio.com

Versio provides a Do-It-Yourself credit repair software that’s a good alternative for the best credit restoration companies on the market. The software leverages advanced artificial intelligence to identify accounts that are impacting scores and generate professional dispute letters. This allows you to file an unlimited number of challenges. After filing challenges with the credit bureaus, you can also track your results with the program.

The basic package goes for $19.95, making Versio a good alternative for cheap credit repair! Users have also expressed that the software is easy to use in the company’s reviews.

- Provides coaching on an individual level

- Reviews certified on Trustpilot

- Real-time result tracking

- Its website has useful informational videos

- Do-It-Yourself credit repair requires more work than an expert-led dispute process

How Do Credit Repair Companies Work?

Did you know that you are able to legally retain a record of your financial history to check its accuracy? Now you do!

Every 12 months you are allowed by law to obtain records from the three biggest national credit bureaus for free for your keeping. These are the same bureaus that organizations will check:

- Experian

- Equifax

- TransUnion

How Professionals Improve Your Financial Standing

To successfully fix bad credit, these companies need access to important documents of yours that credit bureaus have obtained over the years. The bureaus we just looked at are the ones credit repair experts will look at, but not every bureau will hold the same information about you, and some may have no information at all. That is because the creditors that worked on your case may not report to all of them.

Once credit repair companies get a hold of this information, they look to find inaccurate data on your reports that are responsible for your lowering score and credit hit. Once they’ve found these items, they either delete them from your record or find a way to justify them so that things can work in your favor.

They also look at reports such as:

- Bankruptcies

- Failure to pay taxes

- And charge-offs.

When it looks like you aren’t doing so well at keeping up with your finances, taxes, and money owed, it’s going to damage your credit reputation. Giving these credit repair companies access to reports with this information can help you clean them up and make you eligible for loans, apartments, houses, cars, or anything else you’ve had your eye on but haven’t been able to get because of your credit situation.

A Timeline for Improvement

Debt repair can be tricky or even impossible if the information on your reports is proven to be accurate.

When you work with a credit repair company, it may take a while to see the results. Sometimes you may see little to no results.

How long it takes to see results from legitimate credit repair companies varies depending on what your credit report looks like. There are several steps to how professionals work, and it generally looks like this:

- Receive credit report

- Begin filing dispute letter(s) to credit bureaus

- Get a response from a credit bureau

- File redisputes for failed challenges.

Getting the credit report takes no time at all. It’s the quickest step. It takes between one to two hours to get the full report and identify what should be cleaned up.

After you get your report and your credit repair specialist walks you through it, depending on how many errors there are, the next step is to write dispute letters to credit bureaus discussing these errors and requesting that they fix them. Writing the disputes does not take much time. However, waiting for a response might take a little while.

Depending on how many disputes you file, you may be waiting anywhere from three to six months to hear back from the bureaus. They say it’s a 30-day wait for every dispute you file, so if you have several, don’t set a timer. Good credit fixing companies will notify you of any updates on your pending challenges.

What can you do in the meantime?

While you’re waiting for a response from the bureaus to resolve issues with your report, there are some simple things you can do yourself to boost your score. Try to stay on top of your payments, use a free credit monitoring tool that shows you where you are in terms of your credit, and get more credit lines that you can properly manage. All of this can help you maintain and improve your credit score.

Just because you’re waiting for a response from a credit bureau does not mean you can’t be proactive in rebuilding your score. It may take a long time to hear back from the bureaus, even if you chose one of the best credit repair companies in 2022. While you wait, continue building your credit yourself, so you can give an extra boost to your report before the resolutions start to come in.

What Can Credit Repair Companies Do?

A lot of misunderstanding exists about the role of credit repair companies. Note that these organizations can only dispute discrepancies.

Ordinary consumers can undertake the process independently, and the internet is abundant in free advice. However, a credit repair agency may have specialized knowledge, more capable staff, and many years of experience to know what works.

Many credit repair companies offer a wide range of extra services such as helping customers prepare cease and desist letters, Goodwill letters, and debt validation letters. They can also offer expert rebuilding guidance and may go as far as recommending the best products customers should consider.

You may also get free credit reports during the consultation, and many companies partner with third-party services to offer credit monitoring services.

What Can NOT Credit Repair Companies Do?

Note that even the best credit restoration services cannot go after legitimate credit records. For instance, the company may not have the ability to remove delinquencies or bankruptcies. Therefore, legitimate credit repair companies don’t mention that they can remove genuine items.

They provide consultation sessions where they review the client’s credit history to find out what’s causing the poor score. If they can’t find inaccurate information, they will not advise you to sign up for their service.

Be watchful of credit repair professionals making false claims as they are out to scam customers. Before signing up for any service contracts, the law even requires the services to disclose that customers can challenge discrepancies by themselves and obtain similar results.

How Much Does Credit Repair Cost?

You’ve landed yourself in a predicament due to finances, and now you have to pay more for an instant credit repair company. No fun. Luckily, there are options for you to find a low-cost debt repair company.

The cost will vary from agency to agency, but fees can vary from $50 to $149 per month, depending on the package option you choose. You should also factor in the one-time setup fees and other extra costs such as loading credit reports from third-party sites. Since it takes several months to see results, you will be paying for that entire duration. If the price is an important factor for you, look for the best repair company that offers excellent services with great payment options.

Of course, if you want to save money, you could try to repair your score for free. But if you want to make sure you catch all the errors, hire a good credit repair company that offers free repair services like consultations.

You want to see what you and your credit repair specialist will be working with, which will give you an idea of how the company handles its finances.

Tips for choosing a great credit repair service

Repairing your credit may sound like a no-brainer when it needs fixing after taking several hits, but you shouldn’t jump on the first company you see. Repairing your score is a big deal, so you want to make sure the company you choose knows what they’re doing and that you can trust them. You can make this determination by doing some in-depth research. You also want the best credit repair services for your unique situation.

Keep an Eye Out for Scammers!

Just like with anything, you could potentially fall victim to scams when looking for a credit repair service, so you should keep your eye open for red flags when comparing companies. A way to do this is to look at reviews and find the best-rated credit repair companies out there.

The Credit Repair Organizations Act (CROA) went into effect in 1996 and laid out the rules for how credit repair companies should conduct business. The guidelines are set in stone, and there are certain things they should never do.

The CROA requires credit repair companies and employees to do and report the following:

- Notify customers that they can act upon their credit report information freely.

- Sue the organization they work with for violating Credit Repair Organizations Act guidelines.

- Under CROA, credit repair companies are NOT allowed to do the following:

- Advise clients to change their identity

- Guarantee the removal of information from a credit report (*note: if a credit repair company offers this guarantee, it’s a major red flag!)

- Advise clients to make false statements

- Charge fees for services that have not been used.

Working with a credit repair company seems like the best way to improve your credit stance. But nothing is guaranteed. Just because you work with an organization does not mean that things will automatically get better for you. That said, some of the top credit repair companies offer money-back programs. They provide an extra assurance that you’re going to get your money back in case they can’t fix existing errors.

Deciding the Path That’s Right for You

Mistakes may occur, and the company may not find anything at all that they can remove from your report. Accurate information does not budge.

If you are thinking of working with a credit repair company, you should study their services and reputation before deciding to pull the trigger. Credit repair companies do not do anything that you cannot do yourself, so if you would like the professional help of credit repair companies, be sure to choose a company that has a proven reputation by looking at their credit repair reviews.

You don’t want to go with a company that seems sketchy or doesn’t have a great reputation. The best credit repair company will have excellent reviews that demonstrate its competence. It should also have been in business for several years. The proven experience will make you feel comfortable and confident that you have chosen the right company, and your credit repair specialist will likely be able to find several loopholes to boost your score.

To choose the best credit repair company, you need to compare the top-rated credit repair companies to see what they offer and their differences. Find out which company has been around the longest and provides you with the best chance for instant credit repair.

Three Key Considerations

When you choose the credit repair company you want to work with, ask yourself these questions:

- Do they offer affordable credit repair services?

- Do they offer fast credit repair services?

- Do they offer instant credit repair?

- Are they the best out of the top credit repair services?

The best credit repair agencies should provide reputable credit repair services such as free consultations, adhere to CROA laws, and offer some kind of assurance with fee cuts if they do not perform a certain way. These are the best credit repair companies to work with.

How to Avoid a Credit Repair Scam?

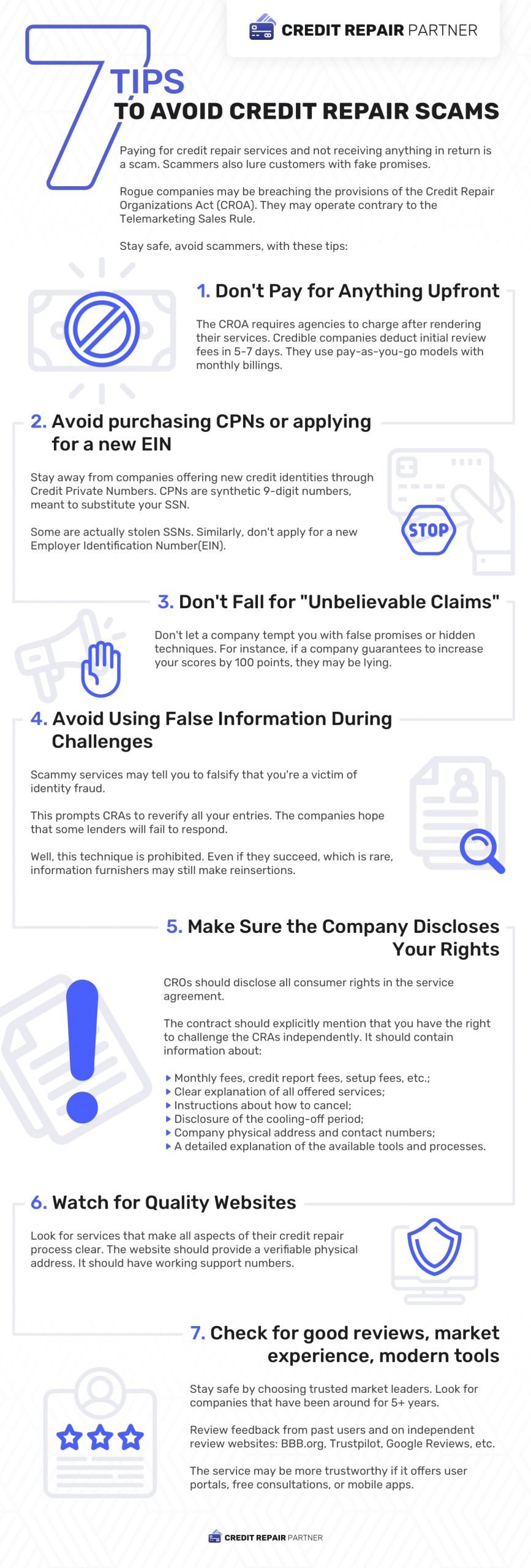

You can also check this handy infographic for more tips on avoiding credit repair scams. In summary, watch out for:

- Any professionals offering guaranteed credit repair of accurate and factual negative credit entries such as late payments or bankruptcies;

- Companies taunting impossible promises such as a “120-point increase in two weeks” as no one can predict the outcome of challenges and the resulting point increase;

- Professionals that promote illegal repair techniques such as lying that you’re a victim of identity theft;

- Service contracts that don’t mention that you can repair credit reports by challenging the credit bureaus directly as per the provisions of the FCRA;

- Contracts that lack other vital information, including the fees, services provided, and cooling-off period;

- Companies that demand an upfront payment or deposit before they begin actual work.

Some of the best places to get reliable feedback from real people are Yelp, Google Reviews, and Reddit. Lastly, compare prices you find on the web and make sure none of the best-rated credit repair companies are offering the same services for cheaper.

Hiring Credit Repair Companies vs DIY

Cleaning up your credit reports can be done in a DIY fashion, nor does it require any special qualifications or schooling. All it takes is plenty of time, close-reading, and good reading skills. If you do not feel like tackling this project yourself though, no worries. There are plenty of businesses that would be happy to repair your credit score for you.

The Credit Repair Organizations Act was put in place to monitor companies advertising their ability to improve laypeople’s credit. As a result, the odds of you being scammed by phony professionals have significantly decreased over the years. That being said, if you choose to take the route of hiring credit repair consultants, you always run the risk that the company is not legit. That’s why it’s up to you to do proper research. Make sure the company you want to use has good reviews and has not gotten into trouble with the Credit Repair Organizations Act before.

Alternatives to Credit Repair Companies

It’s essential to review your budget and determine if you have adequate resources to pay for any top credit repair companies. Paying for credit repair services should not come at the expense of meeting your other expenses or loan obligations. So, here are some of the best credit repair options that may be available to you:

DIY Credit Repair with Software

You can opt for a DIY solution using credit repair software provided by companies such as Credit Versio. The program may be offered for a one-time fee or as a software-as-a-service with monthly billing.

What can the credit repair software do? The software may have the capability to import reports from the bureaus and analyze for negative items that are lowering your credit score.

It may generate custom disputes depending on the nature of the negative entry from pre-built templates. You may need to send the letters manually. So, compared to seeking help from the best credit restoration companies, you still need to perform some work. This is not a done-for-you solution.

Counseling from non-profits

A number of non-profits will offer free credit analysis sessions, where a professional will review your financials and outstanding debts. They will then help create an action plan to help you get out of debt and improve your credit profile.

Credit counseling services offer the first consultation session for free, and it typically lasts for 30 minutes. Customers who need ongoing help with debt management and credit restoration may subscribe for ongoing monthly services.

Credit rebuilder products

It’s possible to offset existing negative entries by applying for new credit rebuilding products, including installment loans and secured credit cards. The lender will report the on-time payments to the bureaus and mark the account as closed in good standing at the end of the loan term. Such accounts can continue contributing positive points for about 10 years.

Becoming an authorized user

A friend or relative can add you as an approved user on their credit cards. They can continue using their cards to make purchases and pay down their balances at the end of each month. Their positive credit behavior will also reflect in your reports.

Several credit-line supply companies have emerged to cater to customers willing to pay to be added as authorized users. The tradeline costs anywhere from $150 to $1,500, and the prices are subject to the tradeline’s quality determined by the age and credit limit.

Tradelines tend to provide a temporary boost to your credit and cannot fully substitute the help of the best credit repair services.

Frequently Asked Questions

Credit repair may be necessary if your credit record has nonfactual information that is impacting credit scores. It is common as errors may be introduced in reports due to reporting mistakes, mistaken identity, clerical errors, or incomplete submissions.

Now, the process entails petitioning credit reporting agencies to remove nonfactual information as per the provisions of the Fair Credit Reporting Act (FCRA).

Consumers may pursue this path by themselves or with the intervention of credit repair companies that assist in investigating reports for errors and preparing custom disputes.

Sometimes it’s possible to go after recently missed payments by asking for Goodwill removals. However, this is not guaranteed to work. Following the removal of material errors, your credit score experiences a boost.

According to our review, customer testimonials on the internet, and the BBB rating, Credit Saint is one of the best credit repair companies in the market right now.

If you are filing disputes with a credit repair company, expect the process to take between three and six months. If you have few report mistakes to fix, you may be done sooner than this. It all depends on the client and their report standing when a credit repair specialist takes a look. It also depends on which of the disputes you send get accepted by the bureau.

There are many reputable credit repair companies. The services are duly bonded and licensed. Legit services operate within the provisions of the Credit Repair Organizations Act and Telemarketing Sales Rule that prohibits the services from making false representations and governs how they market their services to customers.

The best credit repair companies can successfully remove any item from your credit history as long as it’s nonfactual and unverifiable. This allows you to boost your poor credit.

The best company for credit repair will not claim to have the ability to remove legitimate items. Their sales representatives are trained not to offer estimates about the potential credit score increase as they can’t estimate the impact accurately.

Paying your bills on time is the most significant step in repairing your credit since this proves you are on top of things and responsible. It shows that you take care of your money.

If you continue to pay other bills such as utilities and cell phone bills on time, this may help increase your credit score. You can sign up for programs that allow you to report third-party data to the reporting agencies, such as rent payments.

Another quick way you can repair your score is to pay off the debt you have and keep your balances on credit cards and other credit lines low.

Rebuilding your credit score and history is a process that will take some time, but if you take action on your own while simultaneously using a credit repair company, you can make good progress on improving your credit score.

Our methodology for rating credit repair companies

After a thorough analysis of how to best improve your financial state and looking through the top law firms, we’ve determined that these seven businesses are the best credit repair companies to start your score improvement process. Here are the top factors that went into the rankings:

Affordability & well-rounded packages

Your budget was taken into consideration when comparing pricing between the different services and their various plans. Since your finances are probably already on shaky ground if your score is low, making the right financial decisions to avoid any further damage is vital. Most of these companies offer low prices for their basic packages.

Market Experience & Expertise

The most significant consideration when trying to determine the best credit repair firm is how trustworthy the company is, which you can tell by looking at the amount of time the company has been around, and its track record. We believe these seven businesses pass the test for being great credit repair companies for you to work with to build your credit back up.

BBB Ratings & Customers Ratings

When compiling this list of the top credit repair companies in 20212, we also looked at the companies’ BBB ratings, customer reviews, and outcomes of each business.

However, remember that working with credit repair companies does not automatically guarantee improvement if there is no inaccurate data to report in your history.

Summary: Best Credit Repair Companies of 2022

Below, find an easy-to-read table that concisely reviews the basics of some recommended credit repair programs.

| Company | BBB Rating | Setup Fee | Monthly Fee | Money Back |

| Credit Saint | A | $99-$195 | $80-$120 | 90-day |

| Lexington Law | C | $89-$129 | $90-$130 | No |

| CreditRepair.com | D | $70-$120 | $70-$120 | No |

| The Credit Pros | B+ | $119-$149 | $69-$149 | 90-day |

| The Credit People | C+ | $19 | $79 | 6-month *flat-rate membership |

| Sky Blue Credit Repair | A+ | $79 | $79 | 90-day |

| Ovation Credit Services | A+ | $89 | $79-$109 | No |

What is the cheapest credit repair company?

The following three companies may qualify as the most affordable in the credit repair industry:

- The Credit People;

- CreditFirm.net;

- The Credit Pros (Money Management package);

- Creditrepair.com (Direct Package).

Which are the fastest companies?

Based on the availability of electronic disputing, which may facilitate a faster credit repair process, you can consider the following companies:

- Creditrepair.com;

- Lexington Law;

- Ovation Credit.

Which are the best BBB accredited credit repair companies?

- Ovation Credit;

- The Credit Pros;

- Credit Saint.

With the average indebted American being in the hole by at least $5,000, do not feel ashamed or alone if you find yourself in this predicament. The situation is rectifiable with the assistance of the best credit repair companies, as well as some dedication and strategic monetary distribution on your part.

Fixing your score is crucial since it affects your personal financial life. Without good credit, you might not be able to buy the things you need. Finding a good repair company can help you make sure you take proper steps in improving your financial situation accurately and swiftly. Pay to fix your credit soon if you are harboring unneeded financial stress. If you are looking at improving your finances, choosing the best credit repair company in 2022 will get your score to where it needs to be.