Wondering if you can remove bankruptcy from your credit report? Perhaps you bit off more than you could chew—whether it be with an unsecured card or an unexpected turn of life events. Regardless of the reason, most of the time, the answer is no—it usually sticks with you for a long time. However,...

If you are struggling to improve your credit, you should see if it is possible to remove a judgment from your credit report. Judgments are pesky and can, unfortunately, stand in between you and a high score. Are you not sure what a judgment is? Are you wondering how to tell if there are any of them recorded...

Looking to remove negative items from your credit report? There are two main categories of items that can be removed—negative items that are your fault and negative items that are not. This article will detail the steps you need to take to get rid of items that are possible to have removed. You can...

You can remove collections from credit reports by negotiating with debt collectors. This approach has a low success rate, particularly when removing genuine collection accounts. However, it works on some occasions and with a few companies. You should still give it a shot despite the odds. Credit scores...

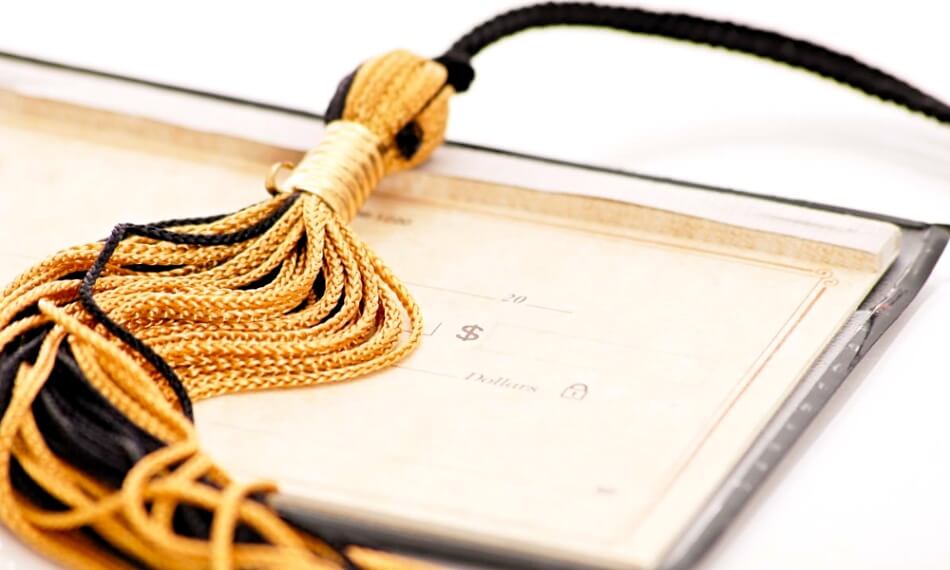

These days, it’s normal for a bachelor’s degree to cost $240,000 or more. The sad reality is that most people cannot afford this, and end up having to take out loans to pay for part or all of their education. If you need a loan to pursue your education, then it’s crucial that you know about removing...

Credit inquiries are, at best, damaging to your credit score in the short term, and at worst, incredibly detrimental in the long term. However, if you have one of these bad marks on your account, do not abandon hope of improving your standing by removing collections from your credit report. Most of the...

Lenders may make mistakes as they report information to CRBs. You may have been making on-time payments and still end up with late payment entries. Consumers can remove late payments from the credit report by disputing errors with CRBs or seeking help from credit repair companies. Creditors report genuine...

The Federal Trade Commission estimates that 1 in 5 people has material errors in their reports. These are mistakes that impact scores and may disqualify you during the loan approval process. DIY credit repair entails trying to clean up reports without the help of paid credit repair services. It’s a...

Raising credit scores by 200 points is not an impossible task! Probably your credit score is sitting in the lower 600’s or in the upper 500’s because of serious negative marks like collections, bankruptcies, or charge-offs. Maybe, you’re credit averse and don’t like owing banks or card companies....

According to Transunion, 45 days is the response to the question of how often the credit score updates. Besides, it is possible to get an 800 credit score or higher if you continue to work on it. It is essential because your score is typically the first thing lenders notice when deciding to approve...